What is a Schedule C?

|

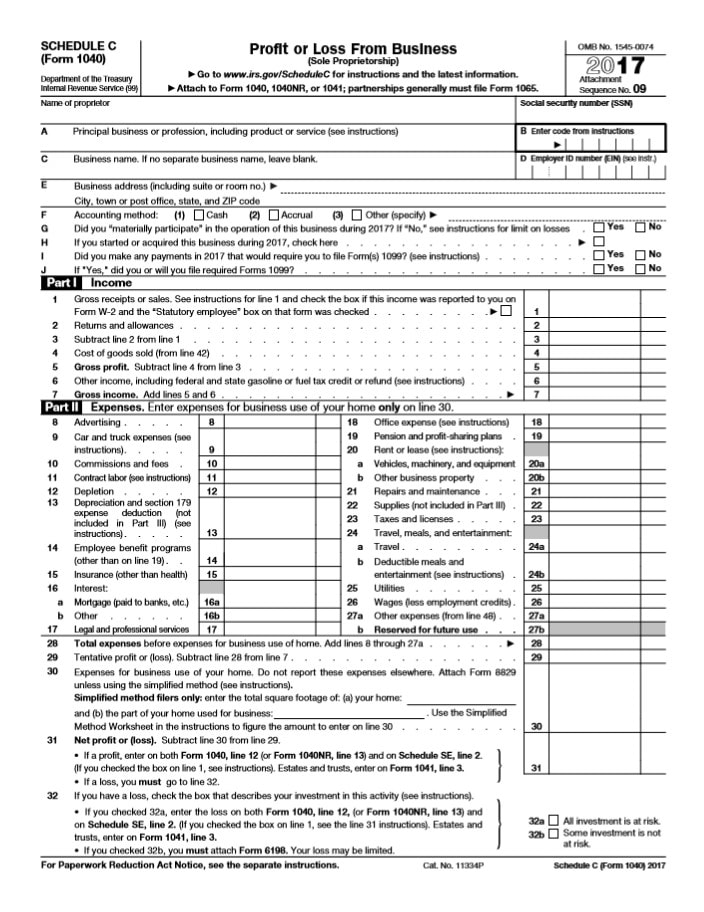

Schedule C, Profit or Loss From Business is the primary IRS form used to report the income and expenses for a sole proprietorship. If you own your own business, have not incorporated or filed any other formation documents, then you will file a Schedule C with your personal income tax return to report the income and expenses for that business.

Sole proprietorships typically include: Real Estate Professionals Health Insurance Sales Agents Indepenent Contractors Landscape Professionals Consultants Independent Sales Agents Mary Kay Avon Amway |